"The difference between average people and achieving people is their perception of and response to failure." -- John Maxwell

NEW YORK (TheStreet) -- We saw very slow and weak action all day leading into the Federal Open Market Committee meeting.

It's never fun watching your stocks float lower but with the news to come I had to hold onto my stocks and see how they reacted to the news. Had they reacted poorly I would have just had to suck it up and take more of a loss, or smaller gains, than I wanted.

My thinking was stocks would come back and were just trying to shake week hands out. Luckily, I was right this time and the news was a non-event.

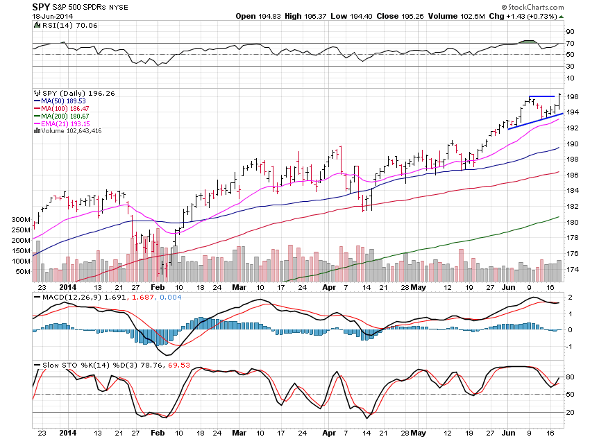

We saw some great moves and some superb closes in many leading stocks. The closing price is always the most important price to focus on. Let's move right into the SPDR S&P 500 ETF Trust (SPY) chart that has now cancelled out the small head and shoulders pattern and should now rip higher -- just how I like it. I am still into margin and only did one trade today, adding a new long position.  SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

We remain in a very strong market environment and buying dips is a great strategy for now along with breakouts. No matter what the bears tell you, the action speaks for itself and that is what I listen to, not someone's opinion. We still are on track for a very busy and strong summer. Enjoy your evening. Warren Bevan This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff. >>Caveat Emptor, Investors: The Regulators Are Trying to Protect You

No comments:

Post a Comment