BALTIMORE (Stockpickr) -- Taper? What taper? Fed Chairman Ben Bernanke may as well have worn a suit made of money and a solid gold grill to his press conference yesterday. It would sent the same message to Wall Street: this tap ain't dry yet.

But even though the Fed went with the boilerplate minutes release and conventional 2 p.m. press conference, it didn't take long for investors to get the message. The S&P 500 shoved up hard to close at 1,725.52 -- a new all-time high for the big index.

From a technical standpoint, this move is textbook after the bounce off support we got earlier this month.

I've heard plenty of people claim that prolonged quantitative easing means "more free money." Make no mistake: QE isn't free. Not by a long shot. But the Fed is dishing it out no matter what, so anyone who doesn't position themselves long equities in the face of it is setting themselves up for failure.

And this week, the technicals are helping us spot some of the most attractive setups. Today, we'll take a closer look at five of them.

If you're new to technical analysis, here's the executive summary.

Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms, and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five high-volume stocks to trade this week.

WisdomTree Investments

2013 has been a stellar year for asset manager WisdomTree Investments (WETF); shares have nearly doubled since the calendar flipped over to January. That's not a huge surprise considering the fact that investment firms are effectively leveraged plays on this equity rally. But now, the technical setup forming in shares of WisdomTree points to even higher ground for the rest of the year.

Right now, WETF is forming an ascending triangle pattern, a bullish setup that's formed by a horizontal resistance level above shares at $14 and uptrending support to the downside. Basically, as WETF bounces in between those two technical levels, it's getting squeezed closer and closer to a breakout above that $14 level. When that happens, investors have a buy signal.

WisdomTree isn't exactly cheap right now. From a fundamental standpoint, this stock looks downright pricey -- but that has little to do with shares' price action right now. Until the technicals change, the high probability returns remain on the long-side of WETF.

Toyota Motors

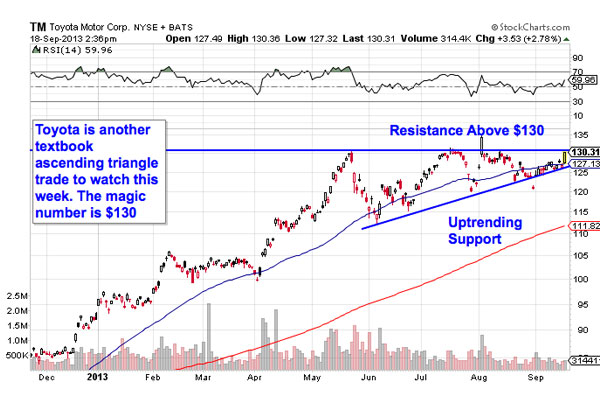

We're seeing the exact same setup in shares of Japanese automaker Toyota Motors (TM). Toyota has been forming an ascending triangle of its own since the start of May -- but now, shares are getting extremely close to breaking out above their resistance level at $130. That $130 breakout is the buy signal for Toyota.

Whenever you're looking at any technical price pattern, it's critical to think in terms of buyers and sellers. Triangles and other price pattern names are a good quick way to explain what's going on in this stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That resistance line at $130, for example, is a price where there is an excess of supply for shares; in other words, it's a place where sellers have been more eager to sell and take gains than buyers have been to buy. That's what makes a confirmed breakout above $130 so significant; it means buyers have finally wrestled control of this stock.

The 50-day moving average has acted as a good proxy for support on the way up – that makes it a logical place to keep a protective stop if you decide to become a buyer.

Dunkin' Brands Group

Dunkin' Brands Group (DNKN) is another name that's fared much better than the market since the start of 2013. Year-to-date, Dunkin' has rallied more than 38%, outpacing the S&P by close to double digits. A breakout earlier this week points to more upside in DNKN in the short-term.

After rallying hard to start the year, Dunkin' spent the last few months consolidating sideways, bleeding off some overbought momentum after a long-term move higher. DNKN's consolidation was bounded by horizontal resistance at $45 and horizontal support down at $42, forming a setup called a "rectangle." The rectangle gets its name because it effectively "boxes in" a stock's price action between two levels. When a stock breaks out from the range, it becomes tradable.

The logic behind a rectangle breakout is the same as the triangles in Toyota and WisdomTree; Monday's breakout in DNKN means that buyers have finally wrestled control of this stock from sellers. Shares haven't rocketed away after their move, and that's providing a second chance at a low-risk entry for buyers. If you decide to jump in here, just be sure to use proper risk management with a tight stop under $45.

CA

The chart of CA (CA) doesn't need much introduction -- it's about as simple as a technical pattern gets. CA is currently bouncing higher in an uptrending channel, a setup that gives us a very high probability range for shares of CA to remain within. Here's how to trade it.

Trendline support is the price level to watch right now in CA -- it's been the floor that's kept CA bouncing higher each of the last five times it's been tested. Even though it generally makes sense to be a buyer anywhere in an uptrend, the ideal time to buy comes on a bounce off of support.

Buying off a support bounce makes sense for two big reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). With little room between the trendline support line and CA's most recent price, this week looks like as good a time as any to start building a position.

Oi

There's no two ways about it: Brazilian telco Oi (OIBR) has gotten shellacked in recent months alongside the rest of the emerging market. But this stock is starting to look "bottomy" right now, and the Fed's latest no-taper announcement should provide an extra shot in the arm in September.

Oi is currently forming a double-bottom setup, a pattern that's identified by two swing lows that take place at approximately the same level. The bottoms are separated by an swing high that's in between them. That peak is the breakout level that tells traders when the reversal pattern is complete. In the case of OIBR, that level is $2.10. Yesterday's 9.6% rally in OIBR brought shares within a nickel of closing at that $2.10 breakout level, but I'd suggest waiting for a material move through it before putting money on this trade.

In the meantime, momentum adds some extra confirmation to the move; 14-day RSI has been in an uptrend since the second rally started that's bringing it into "overbought" territory. Contrary to popular belief, going overbought is statistically a better indicator of higher prices than a reversal.

OIBR is a volatile name, so it's likely to move quickly this week. Keep a close eye on that share price if you're looking to trade it.

To see this week's trades in action, check out this week's Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

Getty Images

Getty Images

The next 24: U.S. housing prices

The next 24: U.S. housing prices  MarketWatch/William Watts European stocks rise on Tuesday. U.S. consumer confidence drops

MarketWatch/William Watts European stocks rise on Tuesday. U.S. consumer confidence drops

Exxon Mobil

Exxon Mobil  Burns (left) called it “confounding” that a huge segment of investors have not participated in the stock market rally, describing the heavy flow into fixed income as a “retroactive fix” of a bad asset allocation that overweighted stocks prior to the financial crisis.

Burns (left) called it “confounding” that a huge segment of investors have not participated in the stock market rally, describing the heavy flow into fixed income as a “retroactive fix” of a bad asset allocation that overweighted stocks prior to the financial crisis.