Exchange traded funds (ETFs) and closed-end funds (CEFs) are composed of many different individual securities. This usually results in uneven dividend distributions. Some funds have tried to address this with a managed distribution policy. In short, a managed distribution policy is management's commitment to make a fixed periodic dividend payment.

How Managed Distribution Policies Work

Since many funds distribute most of their income to shareholders in order to avoid taxation, funds with a managed distribution policy sometimes have cash left over at year-end that needs to be distributed. This is is normally done as a "special" one-time dividend. However, if the fund generates insufficient cash to cover the dividend, the fund is forced to sell some investments to cover the cash short-fall. In turn, this portion of the short-fall is treated as a return of capital and the fund now has lower assets to generate future income.

Advantages of Managed Distribution Policies

According to a Gabelli Funds report, managed distribution policies offer several advantages, including:1. Lower difference between the fund's market price and its NAV per share.2. Provides support during periods when the stock market is in a decline.3. Provides a measurable performance target for the investment adviser.Below are several high-yield funds from CEFA that have a managed distribution policy (yields as of December 16):Aberdeen Australia Eqty (IAF)- Distribution Yield: 10.4%- Income Yield: 3.46%Bexil Advisers LLC (DNI)- Distribution Yield: 11.1%- Income Yield: 3.56%BlackRock En Capital&Inc (CII)- Distribution Yield: 8.78%- Income Yield: 2.34%Cornerstone Strat Value (CLM)- Distribution Yield: 18.77%- Income Yield: 1.83%Cornerstone Total Return (CRF)- Distribution Yield: 19.10%- Income Yield: 0.85%Delaware Inv Div & Inc (DDF)- Distribution Yield: 6.70%- Income Yield: 5.26%Gabelli Equity Trust (GAB)- Distribution Yield: 7.58%- Income Yield: 1.54%Gabelli Utility Trust (GUT)- Distribution Yield: 9.45%- Income! Yield: 2.84%MFS Special Value Trust (MFV)- Distribution Yield: 9.60%- Income Yield: 5.73%Nuveen Tx-Adv TR Strat (JTA)- Distribution Yield: 6.70%- Income Yield: 3.12%TCW Strategic Income (TSI)- Distribution Yield: 10.54%- Income Yield: 7.88%Zweig Total Return (ZTR)- Distribution Yield: 7.27%- Income Yield: 1.95%As noted in the Gabelli report, a managed distribution policy may create confusion regarding the true current yield since the reported yield includes the return of capital portion. You can see the disparity above between the income yield and the distribution (reported) yield.If you are looking for a sustainable and growing dividend, you may want to consider some blue-chip dividend stocks such as these with a Free Cash Flow Payout less than 50%, 50+ years of consecutive dividend increases and a 2%+ yield:3M Co. (MMM) is a diversified global company provides enhanced product functionality in electronics, health care, industrial, consumer, office, telecommunications, safety & security and other markets via coatings, sealants, adhesives, and other chemical additives. Yield: 2.0%Illinois Tool Works Inc. (ITW) is a diversified manufacturer operates a portfolio of 60 business units that serve industrial and consumer markets globally. Yield: 2.1%Colgate-Palmolive Company (CL) is a major consumer products company that markets oral, personal and household care and pet nutrition products in more than 200 countries and territories. Yield: 2.1%Emerson Electric Co. (EMR) designs and supplies product technology, and delivers engineering services and solutions to a wide range of industrial, commercial and consumer markets around the world. Yield: 2.5%Genuine Parts Co. (GPC) is a leading wholesale distributor of automotive replacement parts, industrial parts and supplies, and office products. Yield: 2.6%Cincinnati Financial Corp. (CINF) is an insurance holding company that primarily markets property and casualty coverage. It also conducts life insurance and asset management operations. Yield: 3.2%When investi! ng in a f! und with a managed distribution policy, it is important not to confuse predictable cash flows with assured cash flows. A managed distribution policy means that the funds management is making an attempt to smooth out cash flows, but there is no guarantee they will be successful. Yield:Full Disclosure: Long ITW, EMR, GPC, CINF in my Dividend Growth Portfolio. See a list of all my dividend growth holdings here.Related Articles- 8 Higher-Yielding Consumer Stocks With A History of Rising Dividends- 10 Dividend Stocks For The Ultimate In Deferred Gratification- 6 Healthcare Stocks With Growing Dividends Yeilding In Excess of 2%- Why We Are Dividend Growth Investors- 6 Dividend Growth Stocks With Very Little Debt

About the author:

Dividends4Life

Visit Dividends4Life at:

http://www.dividend-growth-stocks.com/

| Currently 5.00/512345 Rating: 5.0/5 (1 vote) |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MMM STOCK PRICE CHART

136.99 (1y: +47%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'MMM', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1356501600000,93.07],[1356588000000,92.64],[1356674400000,91.78],[1356933600000,92.85],[1357106400000,94.78],[1357192800000,94.67],[1357279200000,95.37],[1357538400000,95.49],[1357624800000,95.5],[1357711200000,96.41],[1357797600000,96.89],[1357884000000,96.28],[1358143200000,97.08],[1358229600000,97.29],[1358316000000,97.6],[1358402400000,98.08],[1358488800000,98.74],[1358834400000,99.33],[1358920800000,99.49],[1359007200000,99.67],[1359093600000,100.59],[1359352800000,100.65],[1359439200000,101.81],[1359525600000,100.8],[1359612000000,100.55],[1359698400000,101.56],[1359957600000,100.77],[1360044000000,101.49],[1360130400000,102.69],[1360216800000,102.22],[1360303200000,102.66],[1360562400000,102.62],[1360648800000,103.46],[1360735200000,102.86],[1360821600000,102.78],[1360908000000,103.23],[1361253600000,104.18],[1361340000000,103.15],[1361426400000,102.72],[1361512800000,103.54],[1361772000000,101.75],[1361858400000,102.31],[1361944800000,103.57],[1362031200000,104],[1362117600000,103.77],[1362376800000,103.28],[1362463200000,104.45],[1362549600000,104.66],[1362636000000,104.54],[1362722400000,105.71],[1362978000000,105.81],[1363064400000,105.13],[1363150800000,105.09],[1363237200000,106.02],[1363323600000,106.4],[1363582800000,105.41],[1363669200000,105.18],[1363755600000,105.66],[1363842000000,104.94],[1363928400000,106.42],[1364187600000,105.17],[1364274000000,106.07],[1364360400000,105.29],[1364446800000,106.31],[1364792400000,105.65],[1364878800000,106.52],[1364965200000,105.68],[1365051600000,105.82],[1365138000000,105.78],[13653

136.99 (1y: +47%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'MMM', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1356501600000,93.07],[1356588000000,92.64],[1356674400000,91.78],[1356933600000,92.85],[1357106400000,94.78],[1357192800000,94.67],[1357279200000,95.37],[1357538400000,95.49],[1357624800000,95.5],[1357711200000,96.41],[1357797600000,96.89],[1357884000000,96.28],[1358143200000,97.08],[1358229600000,97.29],[1358316000000,97.6],[1358402400000,98.08],[1358488800000,98.74],[1358834400000,99.33],[1358920800000,99.49],[1359007200000,99.67],[1359093600000,100.59],[1359352800000,100.65],[1359439200000,101.81],[1359525600000,100.8],[1359612000000,100.55],[1359698400000,101.56],[1359957600000,100.77],[1360044000000,101.49],[1360130400000,102.69],[1360216800000,102.22],[1360303200000,102.66],[1360562400000,102.62],[1360648800000,103.46],[1360735200000,102.86],[1360821600000,102.78],[1360908000000,103.23],[1361253600000,104.18],[1361340000000,103.15],[1361426400000,102.72],[1361512800000,103.54],[1361772000000,101.75],[1361858400000,102.31],[1361944800000,103.57],[1362031200000,104],[1362117600000,103.77],[1362376800000,103.28],[1362463200000,104.45],[1362549600000,104.66],[1362636000000,104.54],[1362722400000,105.71],[1362978000000,105.81],[1363064400000,105.13],[1363150800000,105.09],[1363237200000,106.02],[1363323600000,106.4],[1363582800000,105.41],[1363669200000,105.18],[1363755600000,105.66],[1363842000000,104.94],[1363928400000,106.42],[1364187600000,105.17],[1364274000000,106.07],[1364360400000,105.29],[1364446800000,106.31],[1364792400000,105.65],[1364878800000,106.52],[1364965200000,105.68],[1365051600000,105.82],[1365138000000,105.78],[13653

136.99 (1y: +47%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'MMM', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1356501600000,93.07],[1356588000000,92.64],[1356674400000,91.78],[1356933600000,92.85],[1357106400000,94.78],[1357192800000,94.67],[1357279200000,95.37],[1357538400000,95.49],[1357624800000,95.5],[1357711200000,96.41],[1357797600000,96.89],[1357884000000,96.28],[1358143200000,97.08],[1358229600000,97.29],[1358316000000,97.6],[1358402400000,98.08],[1358488800000,98.74],[1358834400000,99.33],[1358920800000,99.49],[1359007200000,99.67],[1359093600000,100.59],[1359352800000,100.65],[1359439200000,101.81],[1359525600000,100.8],[1359612000000,100.55],[1359698400000,101.56],[1359957600000,100.77],[1360044000000,101.49],[1360130400000,102.69],[1360216800000,102.22],[1360303200000,102.66],[1360562400000,102.62],[1360648800000,103.46],[1360735200000,102.86],[1360821600000,102.78],[1360908000000,103.23],[1361253600000,104.18],[1361340000000,103.15],[1361426400000,102.72],[1361512800000,103.54],[1361772000000,101.75],[1361858400000,102.31],[1361944800000,103.57],[1362031200000,104],[1362117600000,103.77],[1362376800000,103.28],[1362463200000,104.45],[1362549600000,104.66],[1362636000000,104.54],[1362722400000,105.71],[1362978000000,105.81],[1363064400000,105.13],[1363150800000,105.09],[1363237200000,106.02],[1363323600000,106.4],[1363582800000,105.41],[1363669200000,105.18],[1363755600000,105.66],[1363842000000,104.94],[1363928400000,106.42],[1364187600000,105.17],[1364274000000,106.07],[1364360400000,105.29],[1364446800000,106.31],[1364792400000,105.65],[1364878800000,106.52],[1364965200000,105.68],[1365051600000,105.82],[1365138000000,105.78],[13653

AP, Rockstar GamesGrand Theft Auto V has been a big winner for Take-Two Interactive. When it releases its earnings this week, we'll find out just how big. You can never know in advance all the news that will move the market in a given week, but some things you can see coming. From earnings reports out of Apple to a deal on burritos on Halloween, here are some of the items that will help shape the week that lies ahead on Wall Street. Monday -- An Apple a Day: Last Tuesday Apple (AAPL) had the ear of consumers as it introduced new iPads, iMacs, and an updated operating system. Monday afternoon it will be time to sway investors with its fiscal fourth quarter report. Apple is still the top dog in consumer electronics, but iPad, iPod, and Mac sales have been slipping lately. Apple's iPhone is the only product category growing, and the end result is that analysts see flat revenue growth at Apple on declining profitability. Apple's quarter ended with the welcome news that it had sold 9 million iPhone 5s and iPhone 5c devices in their initial weekend of availability. Now it's time to see if it was enough to save Apple's quarter. Tuesday -- Game On: After years of sluggish sales the video game console industry showed signs of life last month. Take-Two Interactive's (TTWO) Grand Theft Auto V was a smashing success, helping push the industry to a rare monthly gain. Things will get even more interesting next month when the Xbox One and PlayStation 4 hit the market. The market will get a good read on the state of the industry on Tuesday as Take-Two Interactive and the larger Electronic Arts (EA) report fresh earnings. It may be too early for either company to have reliable projections on how the new consoles will fare, but any insight would be incremental at this point. Wednesday -- Face to Facebook: One of last year's most prolific IPOs was Facebook (FB). The leading social networking website operator went public at $38, but a few months later the stock was -- like the site's original core audience -- trading in the teens. Facebook has clawed its way back. It's no longer a broken IPO, and Facebook's success in busting through that $38 IPO ceiling this summer probably played a major part in Twitter's decision to go through with an offering of its own. Facebook reports on Wednesday, letting the market know how it's doing in monetizing mobile. More and more users are interacting with the site through smartphones and tablets, and while that was at first interpreted as a detriment, we've seen Facebook come up with new ways to make mobile usage pay off. Thursday -- Scaring Up Some Grub: It's Halloween, and while kids and kids at heart will tell you that it's all about the free candy, there's at least one way to score a pretty healthy discount on dinner after a night of collecting Hershey bars and candy corn. Chipotle Mexican Grill (CMG) is once again hosting what it calls Boorito. From 4 p.m. to close on Thursday, anyone walking into a Chipotle in a costume will be able to order a burrito, bowl, salad, or taco order for just $3. That's nearly half off the going rate for the "food with integrity" chain that now has more than 1,500 locations worldwide. All proceeds -- up $1 million -- benefit the Chipotle Cultivate Foundation. The treat is no trick. Friday -- Bringing a Steak Knife to a Gunfight: Restaurants have been struggling lately, but upscale steakhouses have actually held up fairly well. Well-to-do consumers hungry for a good steak and wedge salad have been heading out to fancy chophouses lately. We'll get a decent snapshot of the upscale market when Ruth's Hospitality (RUTH) reports. This is the parent company of the Ruth's Chris chain of high-end steakhouses. The stock has nearly doubled over the past year, and it's going to need to keep serving up "well done" reports to keep it that way.

AP, Rockstar GamesGrand Theft Auto V has been a big winner for Take-Two Interactive. When it releases its earnings this week, we'll find out just how big. You can never know in advance all the news that will move the market in a given week, but some things you can see coming. From earnings reports out of Apple to a deal on burritos on Halloween, here are some of the items that will help shape the week that lies ahead on Wall Street. Monday -- An Apple a Day: Last Tuesday Apple (AAPL) had the ear of consumers as it introduced new iPads, iMacs, and an updated operating system. Monday afternoon it will be time to sway investors with its fiscal fourth quarter report. Apple is still the top dog in consumer electronics, but iPad, iPod, and Mac sales have been slipping lately. Apple's iPhone is the only product category growing, and the end result is that analysts see flat revenue growth at Apple on declining profitability. Apple's quarter ended with the welcome news that it had sold 9 million iPhone 5s and iPhone 5c devices in their initial weekend of availability. Now it's time to see if it was enough to save Apple's quarter. Tuesday -- Game On: After years of sluggish sales the video game console industry showed signs of life last month. Take-Two Interactive's (TTWO) Grand Theft Auto V was a smashing success, helping push the industry to a rare monthly gain. Things will get even more interesting next month when the Xbox One and PlayStation 4 hit the market. The market will get a good read on the state of the industry on Tuesday as Take-Two Interactive and the larger Electronic Arts (EA) report fresh earnings. It may be too early for either company to have reliable projections on how the new consoles will fare, but any insight would be incremental at this point. Wednesday -- Face to Facebook: One of last year's most prolific IPOs was Facebook (FB). The leading social networking website operator went public at $38, but a few months later the stock was -- like the site's original core audience -- trading in the teens. Facebook has clawed its way back. It's no longer a broken IPO, and Facebook's success in busting through that $38 IPO ceiling this summer probably played a major part in Twitter's decision to go through with an offering of its own. Facebook reports on Wednesday, letting the market know how it's doing in monetizing mobile. More and more users are interacting with the site through smartphones and tablets, and while that was at first interpreted as a detriment, we've seen Facebook come up with new ways to make mobile usage pay off. Thursday -- Scaring Up Some Grub: It's Halloween, and while kids and kids at heart will tell you that it's all about the free candy, there's at least one way to score a pretty healthy discount on dinner after a night of collecting Hershey bars and candy corn. Chipotle Mexican Grill (CMG) is once again hosting what it calls Boorito. From 4 p.m. to close on Thursday, anyone walking into a Chipotle in a costume will be able to order a burrito, bowl, salad, or taco order for just $3. That's nearly half off the going rate for the "food with integrity" chain that now has more than 1,500 locations worldwide. All proceeds -- up $1 million -- benefit the Chipotle Cultivate Foundation. The treat is no trick. Friday -- Bringing a Steak Knife to a Gunfight: Restaurants have been struggling lately, but upscale steakhouses have actually held up fairly well. Well-to-do consumers hungry for a good steak and wedge salad have been heading out to fancy chophouses lately. We'll get a decent snapshot of the upscale market when Ruth's Hospitality (RUTH) reports. This is the parent company of the Ruth's Chris chain of high-end steakhouses. The stock has nearly doubled over the past year, and it's going to need to keep serving up "well done" reports to keep it that way.

Alamy U.S. home prices jumped 12.4 percent in July from a year earlier, reflecting a housing market that's increasingly favoring sellers amid a tight supply of available homes for sale. Real estate data provider CoreLogic said Tuesday that home prices in every state but Delaware climbed on annual basis in July. Also, 99 of the 100 largest cities reported annual price gains. Home prices grew 27 percent in Nevada, to lead all states. CoreLogic also says prices rose 1.8 percent from June, the 17th straight month-over-month increase. Consistent job gains and mortgage rates that are still historically low despite recent upticks are spurring more people to buy homes. That's helped drive prices higher. CoreLogic says U.S. home prices are now within 18 percent of their peak levels reached in April of 2006.

Alamy U.S. home prices jumped 12.4 percent in July from a year earlier, reflecting a housing market that's increasingly favoring sellers amid a tight supply of available homes for sale. Real estate data provider CoreLogic said Tuesday that home prices in every state but Delaware climbed on annual basis in July. Also, 99 of the 100 largest cities reported annual price gains. Home prices grew 27 percent in Nevada, to lead all states. CoreLogic also says prices rose 1.8 percent from June, the 17th straight month-over-month increase. Consistent job gains and mortgage rates that are still historically low despite recent upticks are spurring more people to buy homes. That's helped drive prices higher. CoreLogic says U.S. home prices are now within 18 percent of their peak levels reached in April of 2006.

Gabe Souza/Portland Press Herald/Getty Images Many investors are looking for an explanation for why the markets have fallen recently. There's no shortage of investment "pros" eager to provide their insights. Regrettably, most "gurus" are overconfident of their ability to forecast what will happen. Investors relying on them are likely to make costly mistakes. Jim Cramer, host of CNBC's "Mad Money," is typical of investment "gurus" who show little understanding about what actually moves the market. According to Cramer, "Events drive the market now. That means when there is a negative headline, the market tanks. And when there is an absence of negative news, the market bounces." Here's why he (and many other financial pundits) are fundamentally mistaken. A Different Perspective on News and the Market I interviewed my colleague Larry Swedroe and asked him what causes markets to fall. Swedroe is director of research at The BAM Alliance, with which I am also affiliated. He holds an MBA in finance and investment from New York University and has authored or co-authored 13 books on investing. His latest is "Reducing the Risk of Black Swans: Using the Science of Investing to Capture Returns With Less Volatility." As he explains in his book "Think, Act and Invest Like Warren Buffett," whether the news is good or bad has no effect on stock prices. Stock prices already incorporate all knowable information. They went down because news has been bad. The fact there was bad news in the past does not mean stock prices will continue to fall in the future. It's not current bad news that will drive stock prices. Rather, it's whether the news is better or worse than already expected. If the news is no worse than expected, investors will earn the higher returns that are a result of lower valuations. If the future news is better than expected, but still not good, stock prices should rise. So here's what actually moves markets: Surprises. By definition, surprises can't be forecast. The likelihood of positive surprises is about the same as negative ones. That's why changes in market valuations are random and unpredictable. Keep this in mind the next time a financial "guru" confidently predicts the future direction of the markets. A Different Perspective on Bear Markets No one should be surprised by a bear market, defined as a period where the market goes down 20 percent or more from its high. They have occurred 32 times from 1900 to 2013, or approximately one out of every 3.5 years. The average length of a bear market is 367 days. I am aware of no credible evidence indicating that anyone has the expertise to time bear markets successfully. I asked Swedroe how investors should deal with bear markets. In his view, "the key to success is to stay disciplined." He noted the best way to avoid panic selling is to make sure your asset allocation doesn't include assuming more risk than you have the ability, willingness or need to take. If you don't have a plan and are exposed to excessive stock market risk, you may be in the unenviable position of having to reduce your allocation to equities by selling in a down market. If so, consider your situation to be a wake-up call. It should prompt you to retain an investment adviser who understands basic principles of finance and who will prepare you with a plan to withstand future bear markets. Follow Buffett's Advice Ask yourself if Buffett is reacting and following the predictions of the talking heads. Clearly, he isn't. His advice to investors is to "be fearful when others are greedy and greedy only when others are fearful." Why would you ignore his advice and succumb to fear? Much of the financial media acts irresponsibly when the markets drop. They do so by emphasizing bad news and ignoring good news. The Ebola outbreak in West Africa is a prime example. The few cases of Ebola in this country currently involve individuals who contracted it in West Africa and two health-care workers who were treating one of those people. The possibility of a widespread Ebola epidemic in this country is remote. You would never get that perspective from listening to the news, which highlights the negative and omits positive developments in containing this deadly virus. Good News Is Out There There is positive economic news. The U.S. economy is growing at a faster pace than many expected. The September jobs report was also stronger than expected. And the unemployment rate has fallen to 5.9 percent. Oil prices are down more than 20 percent since June, which should stimulate consumer spending. Interest rates remain at historic lows, providing industry with more opportunities to refinance debt and increase profits. Low interest rates also will encourage refinancing, lower housing payments and permit more people to buy homes. Swedroe cautions that the global stock markets can continue to fall even in the absence of more bad news. He notes that "markets tend to exhibit momentum, both positive and negative. And right now the momentum is clearly negative." With that said, he offers this advice for investors: Stick to your plan. Avoid panic selling. Engage in disciplined rebalancing. To which I would add: Ignore most of the financial news, which is calculated to create panic and anxiety and encourage you to act emotionally. More from Daniel Solin

Gabe Souza/Portland Press Herald/Getty Images Many investors are looking for an explanation for why the markets have fallen recently. There's no shortage of investment "pros" eager to provide their insights. Regrettably, most "gurus" are overconfident of their ability to forecast what will happen. Investors relying on them are likely to make costly mistakes. Jim Cramer, host of CNBC's "Mad Money," is typical of investment "gurus" who show little understanding about what actually moves the market. According to Cramer, "Events drive the market now. That means when there is a negative headline, the market tanks. And when there is an absence of negative news, the market bounces." Here's why he (and many other financial pundits) are fundamentally mistaken. A Different Perspective on News and the Market I interviewed my colleague Larry Swedroe and asked him what causes markets to fall. Swedroe is director of research at The BAM Alliance, with which I am also affiliated. He holds an MBA in finance and investment from New York University and has authored or co-authored 13 books on investing. His latest is "Reducing the Risk of Black Swans: Using the Science of Investing to Capture Returns With Less Volatility." As he explains in his book "Think, Act and Invest Like Warren Buffett," whether the news is good or bad has no effect on stock prices. Stock prices already incorporate all knowable information. They went down because news has been bad. The fact there was bad news in the past does not mean stock prices will continue to fall in the future. It's not current bad news that will drive stock prices. Rather, it's whether the news is better or worse than already expected. If the news is no worse than expected, investors will earn the higher returns that are a result of lower valuations. If the future news is better than expected, but still not good, stock prices should rise. So here's what actually moves markets: Surprises. By definition, surprises can't be forecast. The likelihood of positive surprises is about the same as negative ones. That's why changes in market valuations are random and unpredictable. Keep this in mind the next time a financial "guru" confidently predicts the future direction of the markets. A Different Perspective on Bear Markets No one should be surprised by a bear market, defined as a period where the market goes down 20 percent or more from its high. They have occurred 32 times from 1900 to 2013, or approximately one out of every 3.5 years. The average length of a bear market is 367 days. I am aware of no credible evidence indicating that anyone has the expertise to time bear markets successfully. I asked Swedroe how investors should deal with bear markets. In his view, "the key to success is to stay disciplined." He noted the best way to avoid panic selling is to make sure your asset allocation doesn't include assuming more risk than you have the ability, willingness or need to take. If you don't have a plan and are exposed to excessive stock market risk, you may be in the unenviable position of having to reduce your allocation to equities by selling in a down market. If so, consider your situation to be a wake-up call. It should prompt you to retain an investment adviser who understands basic principles of finance and who will prepare you with a plan to withstand future bear markets. Follow Buffett's Advice Ask yourself if Buffett is reacting and following the predictions of the talking heads. Clearly, he isn't. His advice to investors is to "be fearful when others are greedy and greedy only when others are fearful." Why would you ignore his advice and succumb to fear? Much of the financial media acts irresponsibly when the markets drop. They do so by emphasizing bad news and ignoring good news. The Ebola outbreak in West Africa is a prime example. The few cases of Ebola in this country currently involve individuals who contracted it in West Africa and two health-care workers who were treating one of those people. The possibility of a widespread Ebola epidemic in this country is remote. You would never get that perspective from listening to the news, which highlights the negative and omits positive developments in containing this deadly virus. Good News Is Out There There is positive economic news. The U.S. economy is growing at a faster pace than many expected. The September jobs report was also stronger than expected. And the unemployment rate has fallen to 5.9 percent. Oil prices are down more than 20 percent since June, which should stimulate consumer spending. Interest rates remain at historic lows, providing industry with more opportunities to refinance debt and increase profits. Low interest rates also will encourage refinancing, lower housing payments and permit more people to buy homes. Swedroe cautions that the global stock markets can continue to fall even in the absence of more bad news. He notes that "markets tend to exhibit momentum, both positive and negative. And right now the momentum is clearly negative." With that said, he offers this advice for investors: Stick to your plan. Avoid panic selling. Engage in disciplined rebalancing. To which I would add: Ignore most of the financial news, which is calculated to create panic and anxiety and encourage you to act emotionally. More from Daniel Solin

Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.

Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.

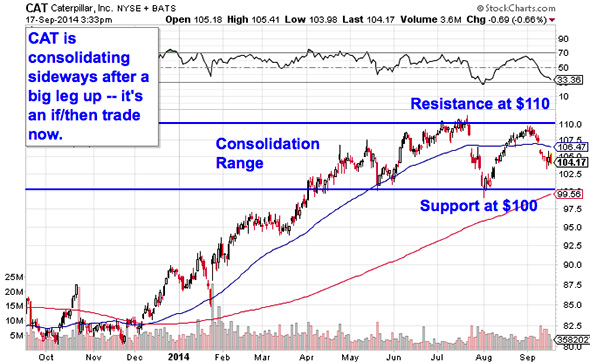

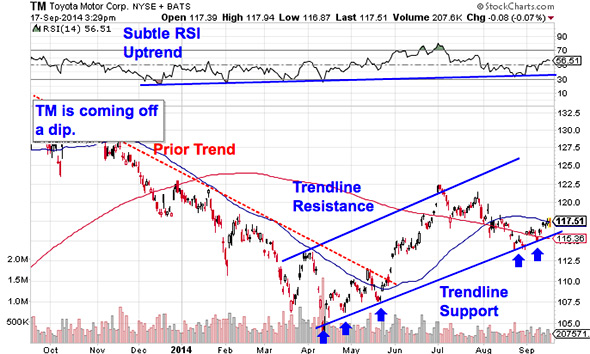

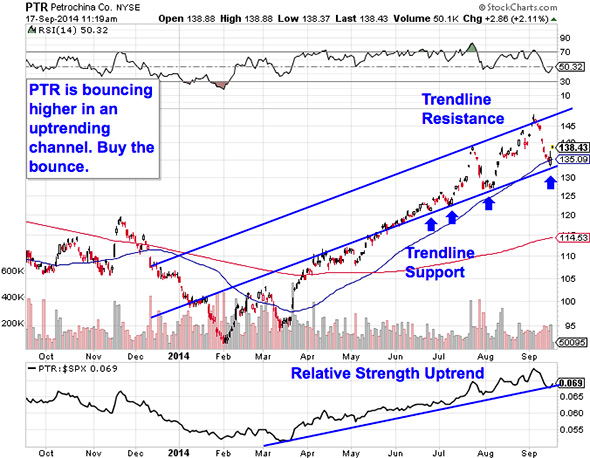

[ Enlarge Image ]

[ Enlarge Image ]