According to GuruFocus Insider Data, the recent CFO sales were: American Tower Corp, Western Refining Inc, and Foot Locker Inc.

American Tower Corp (AMT): EVP & CFO Thomas A Bartlett sold 50,001 Shares

On 01/21/2014, EVP & CFO Thomas A Bartlett sold 50,001 shares at an average price of $83.70. The price of the stock has increased by 9.49% since. American Tower Corp has a market cap of $36.27 billion and its shares were traded at around $91.64. The company has a P/E ratio of 62.70 and P/S ratio of 10.32 with a dividend yield of 1.34%. Over the past 10 years, American Tower Corp had an annual average earnings growth of 12.90%. GuruFocus rated American Tower Corp the business predictability rank of 3-star.

American Tower Corp announced their 2014 first quarter results with revenues of $984.1 million and gross profit of $723.32 million; the net income was $202.5 million. The 2013 total revenue was $3.36 billion, a 17% increase from the 2012 total revenue. The 2013 gross profit was $2.5 billion, a 16% increase from the 2012 gross profit. The 2013 net income was $551.3 million.

On 07/09/2014, EVP, Int'l Operations William H Hess sold 80,000 shares at an average price of $90.45. The price of the stock has increased by 1.32% since. On 04/1/70214, Director Raymond P Dolan sold 10,000 shares at an average price of $83. The price of the stock has increased by 10.41% since. On 04/01/2014, EVP, Chief Admin Officer & GC Edmund Disanto sold 50,000 shares at an average price of $81.24. The price of the stock has increased by 12.8% since.

Western Refining Inc. (WNR): CFO Gary R Dalke Sold 20,000 Shares

On 07/08/2014, CFO Gary R Dalke sold 20,000 shares at an average price of $40.58. The price of the stock has decreased by 0.22% since. Western Refining Inc. has a market cap of $4.15 billion and its shares were traded at around $40.49. The company has a P/E ratio of 14.70 and P/S ratio of 0.36 with a dividend yield of 2.27%.

Western Refining Inc. announced their 2014 first quarter results with revenues of $3.73 billion and gross profit of $319.6 million; the net income was $85.55 million. The 2013 total revenue was $10.1 billion, a 6% increase from the 2012 total revenue. The 2013 gross profit was $821.76 million, an 11% decrease from the 2012 gross profit. The 2013 net income was $276 million.

On 06/23/2014, Director Ralph A Schmidt sold 25,000 shares at an average price of $42.08. The price of the stock has decreased by 3.78% since. On 05/29/2014, Sr. VP – Treasurer Jeffrey S Beyersdorfer sold 5,000 shares at an average price of $41. The price of the stock has decreased by 1.24% since. On 05/16/2014, President and CEO Jeff A Stevens sold 334 shares at an average price of $39.64. The price of the stock has increased by 2.14% since.

Foot Locker Inc. (FL): EVP and CFO Lauren B Peters sold 25,000 Shares

On 07/10/2014, EVP and CFO Lauren B Peters sold 25,000 shares at an average price of $50.75. The price of the stock has decreased by 1.52% since. Foot Locker Inc. has a market cap of $7.23 billion and its shares were traded at around $49.98. The company has a P/E ratio of 16.40 and P/S ratio of 1.11 with a dividend yield of 1.64%. Over the past 10 years, Foot Locker Inc. had an annual average earnings growth of 6.30%.

Foot Locker Inc. announced their 2014 second quarter results with revenues of $1.87 billion and gross profit of $646 million; the net income was $162 million. The 2014 total revenue was $6.5 billion, a 5% increase from the 2013 total revenue. The 2014 gross profit was $2.13 billion, a 5% increase from the 2013 gross profit. The 2014 net income was $429 million.

On 04/17/2014, Director Jarobin Jr Gilbert sold 3,000 shares at an average price of $45.42. The price of the stock has increased by 10.04% since. On 03/26/2014, Director Matthew M McKenna sold 2,175 shares at an average price of $46.08. The price of the stock has increased by 8.46% since. On 03/19/2014, SVP & Chief Accounting Officer Giovanna Cipriano sold 16,459 shares at an average price of $46.41. The price of the stock has increased by 7.69% since.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

AMT STOCK PRICE CHART

91.64 (1y: +20%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AMT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,76.16],[1373950800000,74.71],[1374037200000,73.87],[1374123600000,74.44],[1374210000000,75.13],[1374469200000,74.32],[1374555600000,74.75],[1374642000000,73.94],[1374728400000,72.31],[1374814800000,72.58],[1375074000000,72.42],[1375160400000,72.67],[1375246800000,70.79],[1375333200000,71.28],[1375419600000,70.5],[1375678800000,70.94],[1375765200000,70.27],[1375851600000,69.09],[1375938000000,68.99],[1376024400000,70.16],[1376283600000,69.66],[1376370000000,69.28],[1376456400000,69.7],[1376542800000,69.48],[1376629200000,68.58],[1376888400000,68.36],[1376974800000,69.38],[1377061200000,69.03],[1377147600000,68.88],[1377234000000,70.06],[1377493200000,69.94],[1377579600000,70.06],[1377666000000,69.09],[1377752400000,69.69],[1377838800000,69.49],[1378184400000,69.23],[1378270800000,69.24],[1378357200000,68.75],[1378443600000,71.91],[1378702800000,74.26],[1378789200000,74.58],[1378875600000,75.02],[1378962000000,74.12],[1379048400000,73.71],[1379307600000,74.27],[1379394000000,73.92],[1379480400000,75.75],[1379566800000,74.82],[1379653200000,73.92],[1379912400000,72.96],[1379998800000,72.85],[1380085200000,73.77],[1380171600000,74.63],[1380258000000,74.52],[1380517200000,74.13],[1380603600000,74.06],[1380690000000,73.99],[1380776400000,73.43],[1380862800000,72.69],[1381122000000,73.03],[1381208400000,71.89],[1381294800000,71.62],[1381381200000,73.59],[1381467600000,74.44],[1381726800000,74.64],[1381813200000,74.73],[1381899600000,77.12],[1381986000000,79.34],[1382072400000,79.01],[1382331600000,79.51],[1382418000000,80.13],[1382504400000,79],[1382590800000,80.38],[1382677200000,80.82],[1382936400000,80.3],[1383022800000,80.29],[1383109200000,80.69],[1383195600000,79.35],[1383282000000,79.37],[1383544800000,79],[1383631200000,78.6],[1383717600000,79.53],[1383804000000,78.77],[1383890400000,77.79],[1384149600000,77.45],[1384236000000,77.96],[1384322400000,78.17],[1384! 408800000,79.1],[1384495200000,79.28],[1384754400000,78.57],[1384840800000,78.1],[1384927200000,78.13],[1385013600000,77.59],[1385100000000,77.28],[1385359200000,77],[1385445600000,78.03],[1385532000000,78.37],[1385704800000,77.77],[1385964000000,78.21],[1386050400000,77.71],[1386136800000,77.43],[1386223200000,77.75],[1386309600000,78.08],[1386568800000,78.84],[1386655200000,79.21],[1386741600000,77.81],[1386828000000,76.69],[1386914400000,76.76],[1387173600000,76.09],[1387260000000,76.39],[1387346400000,78.22],[1387432800000,78.11],[1387519200000,77.95],[1387778400000,78.42],[1387864800000,78.71],[1388037600000,78.84],[1388124000000,78.82],[1388383200000,79.8],[1388469600000,79.82],[1388642400000,79.45],[1388728800000,79.68],[1388988000000,80.19],[1389074400000,81.3],[1389160800000,81.94],[1389247200000,82.1],[1389333600000,82.64],[1389592800000,82.14],[1389679200000,82.66],[1389765600000,83.26],[1389852000000,83.27],[1389938400000,83.15],[1390284000000,83.63],[1390370400000,83.42],[1390456800000,83.28],[1390543200000,79.62],[1390802400000,79.25],[1390888800000,80.56],[1390975200000,79.56],[1391061600000,81.18],[1391148000000,80.88],[1391407200000,78.83],[1391493600000,79.14],[1391580000000,79.01],[1391666400000,79.76],[1391752800000,80.38],[1392012000000,81.52],[1392098400000,81.92],[1392184800000,81.79],[1392271200000,82.49],[1392357600000,83.2],[1392703200000,83.53],[1392789600000,83.75],[1392876000000,84.51],[1392962400000,84.05],[1393221600000,82.98],[1393308000000,80.16],[1393394400000,80.83],[1393480800000,81.46],[1393567200000,81.47],[1393826400000,81.46],[1393912800000,81.54],[1393999200000,80.8],[1394085600000,81.92],[1394172000000,81.31],[1394427600000,81.18],[1394514000000,81.7],[1394600400000,80.84],[1394686800000,80.35],[1394773200000,80.39],[1395032400000,81.74],[1395118800000,81.8],[1395205200000,80.68],[1395291600000,81.23],[1395378000000,81.07],[1395637200000,80.9],[1395723600000,81.71],[1395810000000,80.81],[1395896400000,80.67],[1395982800000,82.13],[1396242000000,81.87],[139632840! 0000,81.6! 1],[1396414800000,81.27],[1396501200000,81.25],[1396587600000,80.73],[1396846800000,80.67],[1396933200000,81.5],[1397019600000,81.87],[1397106000000,81.55],[1397192400000,80.55],[1397451600000,81.31],[1397538000000,81.68],[1397624400000,82.38],[1397710800000,82.65],[1398056400000,83.09],[1398142800000,83.93],[1398229200000,84.03],[1398315600000,83.56],[1398402000000,83.08],[1398661200000,83.46],[1398747600000,83],[1398834000000,83.52],[1398920400000,86.23],[1399006800000,87],[1399266000000,88.4],[1399352400000,87.2],[1399438800000,88.35],[1399525200000,88.25],[1399611600000,88.65],[1399870800000,88.31],[1399957200000,88.53],[1400043600000,88.76],[1400130000000,88.66],[1400216400000,88.86],[1400475600000,87.84],[1400562000000,88.03],[1400648400000,88.38],[1400734800000,88.46],[1400821200000,88.41],[1401166800000,89],[1401253200000,89.19],[1401339600000,89.38],[1401426000000,89.63],[1401685200000,88.39],[1401771600000,88.72],[1401858000000,89.01],[1401944400000,89.73],[1402030800000,90.42],[1402290000000,89.66],[1402376400000,89.32],[1402462800000,88.77],[1402549200000,88.24],[1402635600000,88.44],[1402894800000,87.93],[1402981200000,88.23],[1403067600000,88.07],[1403154000000,88.75],[1403240400000,89.1],[1403499600000,89.09],[1403586000000,89.25],[1403672400000,89.28],[1403758800000,88.63],[1403845200000,89.02],[1404190800000,89.71],[1404277200000,89.74],[1404363600000,90.01],[1404709200000,90.73],[1404795600000,90.36],[1404882000000,90.87],[1405054800000,91.64],[1405260590000,91.64],[1405260590000,91.64],[1405090856000,91.64]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=

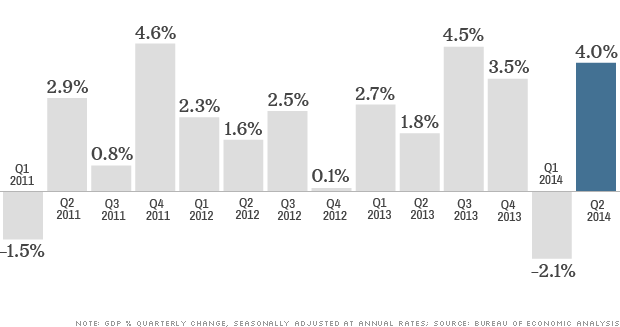

NEW YORK (CNNMoney) What a relief. The deep economic contraction earlier this year was temporary after all.

NEW YORK (CNNMoney) What a relief. The deep economic contraction earlier this year was temporary after all.  Yellen on human toll of unemployment

Yellen on human toll of unemployment  MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  123.2 (1y: +18%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BA',display='';Highcharts.setOptions({glo

123.2 (1y: +18%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BA',display='';Highcharts.setOptions({glo

Ben Margot/AP WASHINGTON -- Average U.S. long-term mortgage rates were stable to slightly higher this week, remaining near their lows for the year. Mortgage company Freddie Mac said Thursday that the nationwide average for a 30-year loan was 4.13 percent, unchanged from last week. The average for the 15-year mortgage, a popular choice for people who are refinancing, edged up to 3.26 percent from 3.23 percent last week. Mortgage rates are below the levels of a year ago, having fallen in recent weeks after climbing last summer when the Federal Reserve began talking about reducing the monthly bond purchases it was making to keep long-term rates low. The government reported Thursday that sales of new homes in the U.S. plunged by 8.1 percent in June, a sign that real estate continues to be a weak spot in the economy. Home sales had been improving through mid-2013, only to stumble over the past 12 months due to a mix of rising prices, higher mortgage rates and meager wage growth. At 4.13 percent, the rate on a 30-year mortgage is down from 4.53 percent at the start of the year. Rates have fallen even though the Fed has been trimming its monthly bond purchases. Fed Chair Janet Yellen told Congress last week that the purchases likely will end completely at the end of October. But at the same time, Yellen said during congressional testimony that the Fed still sees the need to keep its benchmark short-term rate at a record low near zero to give the economy support.

Ben Margot/AP WASHINGTON -- Average U.S. long-term mortgage rates were stable to slightly higher this week, remaining near their lows for the year. Mortgage company Freddie Mac said Thursday that the nationwide average for a 30-year loan was 4.13 percent, unchanged from last week. The average for the 15-year mortgage, a popular choice for people who are refinancing, edged up to 3.26 percent from 3.23 percent last week. Mortgage rates are below the levels of a year ago, having fallen in recent weeks after climbing last summer when the Federal Reserve began talking about reducing the monthly bond purchases it was making to keep long-term rates low. The government reported Thursday that sales of new homes in the U.S. plunged by 8.1 percent in June, a sign that real estate continues to be a weak spot in the economy. Home sales had been improving through mid-2013, only to stumble over the past 12 months due to a mix of rising prices, higher mortgage rates and meager wage growth. At 4.13 percent, the rate on a 30-year mortgage is down from 4.53 percent at the start of the year. Rates have fallen even though the Fed has been trimming its monthly bond purchases. Fed Chair Janet Yellen told Congress last week that the purchases likely will end completely at the end of October. But at the same time, Yellen said during congressional testimony that the Fed still sees the need to keep its benchmark short-term rate at a record low near zero to give the economy support. Getty Images/file 2013

Getty Images/file 2013

Hailing Uber is cheaper than using a traditional yellow cab, at least temporarily. NEW YORK (CNNMoney) Uber, the controversial car-hailing app, is waging war in New York City.

Hailing Uber is cheaper than using a traditional yellow cab, at least temporarily. NEW YORK (CNNMoney) Uber, the controversial car-hailing app, is waging war in New York City.  Inside Uber's billions

Inside Uber's billions  NEW YORK (CNNMoney) A check engine light went off inside Bill Eigen's mind while listening to his auto and truck repair customers in 2007.

NEW YORK (CNNMoney) A check engine light went off inside Bill Eigen's mind while listening to his auto and truck repair customers in 2007.  3 charts explain stocks' bull run

3 charts explain stocks' bull run

Candy Crush maker wins Wall Street points NEW YORK (CNNMoney) It almost looked like "The Return of the KING" on Wall Street Monday.

Candy Crush maker wins Wall Street points NEW YORK (CNNMoney) It almost looked like "The Return of the KING" on Wall Street Monday.