Last month, Apple's (AAPL) stocks soared as rumors about a smart home solution surfaced. But the Cupertino based tech giant is not the only one looking to grab a share of this new segment. Mountain View based Google (GOOG), through Nest Labs' internet-controlled thermostats and fire alarms, was already warming up the space. And now the tech bellwether is in talks to acquire Dropcam, a startup that specializes in cloud-based Wi-Fi video-monitoring and security.

About the deal

The move from Google comes as another step towards its dream of becoming the foremost player in the world of converged devices – ranging right from a smartphone, to smart home solutions and even automobiles.

Dropcam was founded by Greg Duffy and Aamir Virani back in 2009 and till date has raised close to $48 million through three levels of funding from venture capitals. The company is backed by Accel Partners, Menlo Ventures, Mitch Kapor, David Cowan, Aydin Senkut, Ben Narasin, Institutional Venture Partners and Kleiner Perkins Caufield Byers.

The acquisition will come through Google's home automation company Nest Labs. Sources close to the matter said the deal was complete put in place by Nest, which obviously kept Google's vision in mind. The company will have to part with a sum of $555 million in cash for the acquisition. As a part of the deal, Dropcam will shift its functioning from San Francisco to Palo Alto, where Nest is headquartered. However, though confirmed, the deal is yet to close and is awaiting regulatory approvals.

How Dropcam Fits in to Google's Plans

Nest has come a long way since its $3.2 billion acquisition by Google and after the Dropcam acquisition, the company will become a stronger player in the segment. Nest will integrate the expertise acquired from Dropcam into its current line of smart home solutions such as Learning Thermostats and Protect smoke detector.

Dropcam's business offerings are mainly three products – Dropcam, the basic offering that sells for $149; Dropcam Pro, the flagship offering that sells for $199; and Dropcam Tab, a motion detecting device that aids the use of both Dropcam and Dropcam Pro, and sells for $29. The focus of Dropcam's offerings is to enable its users to remotely monitor activities at home through cloud-based video and audio support and motion sensors. The company also offers features such as video sharing with friends and also making the video public through social networking platforms to share it with the world.

Dropcam and Dropcam Pro. Source: Dropcam Website

With features such as these, Nest can think of developing better devices aimed at providing the best in class security features. The consumer electronics space is evolving faster than ever and people want to be connected with everything that matter to them. Apple has already started working on smart home solutions that will be controlled through iPhones and iPads and will allow users incredible amount of flexibility. Unless Google bucks up and starts strengthening its service, it might fall back in the race.

Google is planning to build a world surrounding its devices that will provide its users with seamless integration between all smart devices. A person sitting in this office will be able to check whether his aging mom and dad are fine at home, whether the baby sitter is tacking proper care of his child or not, if someone has broken into his house or not. He will be able to record videos and also interact through voice streaming, he will be able to inform the nearby police station, and all this will be possible through his Android powered devices. Smartphones and tablets will pave the path for the future of all the tech giants and it will be these new-age services and their effectiveness that will decide which tech mammoth will win the space.

Departing Thoughts

The move from Google seems to be a logical one and something that was being expected. While some industry experts are excited about the ongoing developments, some are highly concerned about the repercussions of such developments. Analysts are expressing their concerns over privacy issues and are worried the big corporations might end up invading user privacy. However, Nest has confirmed the Dropcam will come under Nest's privacy policy and thus Google or any other company won't have access to the data without user permission. In my opinion, if Nest and Google and all other companies in this field can take care of the rising concerns over privacy, the tech gurus will be able to surely flourish through offerings such as these.

About the author:Quick PenA seasonal writer with a Management Degree in Finance and interests in automotive, technology, telecommunication and aerospace sectors.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

AAPL STOCK PRICE CHART

90.91 (1y: +58%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AAPL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372050000000,57.506],[1372136400000,57.519],[1372222800000,56.867],[1372309200000,56.254],[1372395600000,56.647],[1372654800000,58.46],[1372741200000,59.784],[1372827600000,60.114],[1373000400000,59.631],[1373259600000,59.293],[1373346000000,60.336],[1373432400000,60.104],[1373518800000,61.041],[1373605200000,60.93],[1373864400000,61.063],[1373950800000,61.456],[1374037200000,61.473],[1374123600000,61.68],[1374210000000,60.707],[1374469200000,60.901],[1374555600000,59.856],[1374642000000,62.93],[1374728400000,62.643],[1374814800000,62.999],[1375074000000,63.97],[1375160400000,64.76],[1375246800000,64.647],[1375333200000,65.239],[1375419600000,66.077],[1375678800000,67.064],[1375765200000,66.464],[1375851600000,66.426],[1375938000000,65.859],[1376024400000,64.921],[1376283600000,66.766],[1376370000000,69.939],[1376456400000,71.214],[1376542800000,71.13],[1376629200000,71.761],[1376888400000,72.534],[1376974800000,71.581],[1377061200000,71.766],[1377147600000,71.851],[1377234000000,71.574],[1377493200000,71.853],[1377579600000,69.799],[1377666000000,70.128],[1377752400000,70.243],[1377838800000,69.602],[1378184400000,69.797],[1378270800000,71.242],[1378357200000,70.753],[1378443600000,71.174],[1378702800000,72.31],[1378789200000,70.663],[1378875600000,66.816],[1378962000000,67.527],[1379048400000,66.414],[1379307600000,64.303],[1379394000000,65.046],[1379480400000,66.383],[1379566800000,67.471],[1379653200000,66.773],[1379912400000,70.091],[1379998800000,69.871],[1380085200000,68.79],[1380171600000,69.46],[1380258000000,68.964],[1380517200000,68.107],[1380603600000,69.709],[1380690000000,69.937],[1380776400000,69.059],[1380862800000,69.004],[1381122000000,69.679],[1381208400000,68.706],[1381294800000,69.513],[1381381200000,69.948],[1381467600000,70.402],[1381726800000,70.863],[1381813200000,71.24],[1381899600000,71.588],[1381986000000,72.071],[1382072400000,72.699],[1382331600! 000,74.48],[1382418000000,74.267],[1382504400000,74.994],[1382590800000,75.987],[1382677200000,75.137],[1382936400000,75.697],[1383022800000,73.811],[1383109200000,74.985],[1383195600000,74.672],[1383282000000,74.29],[1383544800000,75.25],[1383631200000,75.064],[1383717600000,74.417],[1383804000000,73.213],[1383890400000,74.366],[1384149600000,74.15],[1384236000000,74.287],[1384322400000,74.376],[1384408800000,75.451],[1384495200000,74.999],[1384754400000,74.09],[1384840800000,74.221],[1384927200000,73.571],[1385013600000,74.448],[1385100000000,74.257],[1385359200000,74.82],[1385445600000,76.2],[1385532000000,77.994],[1385704800000,79.439],[1385964000000,78.747],[1386050400000,80.903],[1386136800000,80.714],[1386223200000,81.129],[1386309600000,80.003],[1386568800000,80.919],[1386655200000,80.793],[1386741600000,80.194],[1386828000000,80.077],[1386914400000,79.204],[1387173600000,79.643],[1387260000000,79.284],[1387346400000,78.681],[1387432800000,77.78],[13875

Bloomberg

Bloomberg

Popular Posts: Apple Stock Has Gotten Too Far Ahead of ItselfShould I Buy Apple Stock? 3 Pros, 3 ConsNo Merger? No Reason to Buy Sprint Stock, TMUS Recent Posts: Barnes & Noble Split – Why Have One Bad Company When You Can Have Two? Apple Stock Has Gotten Too Far Ahead of Itself 3 Media Stocks to Buy Now View All Posts Barnes & Noble Split – Why Have One Bad Company When You Can Have Two?

Popular Posts: Apple Stock Has Gotten Too Far Ahead of ItselfShould I Buy Apple Stock? 3 Pros, 3 ConsNo Merger? No Reason to Buy Sprint Stock, TMUS Recent Posts: Barnes & Noble Split – Why Have One Bad Company When You Can Have Two? Apple Stock Has Gotten Too Far Ahead of Itself 3 Media Stocks to Buy Now View All Posts Barnes & Noble Split – Why Have One Bad Company When You Can Have Two?  However, it’s a strategy filled with enough magical thinking to wow Harry Potter.

However, it’s a strategy filled with enough magical thinking to wow Harry Potter. Shutterstock / zimmytws Congratulations! Your high school senior just got accepted into college. Yours, and quite a few others -- a large fraction of colleges announce their acceptances around early April. Now, you can brag to all the relatives, and quietly enjoy a profound sense of relief. No more nagging the kid to write those essays. But your work isn't over quite yet. You have just reached the round in determining the survival of the fittest form-fillers, what I call "Darwinnowing": financial aid forms and scholarship applications. More essays, more research, and more ink for the printer, and a whole new test of your mettle as a competitive applicant. The Name of the Game The object of this exercise is to have your offspring graduate with as little debt as possible. The average U.S. undergrad walked across the stage to pick up his diploma carrying $29,000 in student loan debt last year, according to The Project on Student Loan Debt. So maximizing grants and scholarships is key. You may have already received a financial aid award letter from your child's institution of choice, assuming you filed the Free Application for Federal Student Aid. Regardless of your income level, most financial aid offices require the FAFSA as a to financial aid. If you haven't filed this application, please do it . Treat the financial aid award letter as a jumping-off point. Contact the nice people at the school's financial aid office and ask if are there any other state, local, or federal scholarship programs your child qualifies for. Is this amount listed in the letter the maximum possible for your student? Are there any merit-based scholarships? Even after four years of helping my daughter apply, there are always new programs cropping up. If you are the parent of a rising college freshman, ask his or her high school guidance counselor. Most colleges have a decent handle on what's available, but some outside sources are valuable for find less-known scholarships. Your local newspaper may occasionally mention smaller scholarships from area businesses and fraternal organizations. If you can access its archives online, it could be worth searching them. Your employer may offer scholarships for children of employees; a quick trip to HR should suffice to find out. My local grocery store chain has a scholarship competition for teenagers that work over the summer. Keep your eyes peeled everywhere. Thinking Outside the Box There are many free to use websites that are a treasure trove of merit and need-based scholarships. And those awards aren't all targeted to the star athlete/straight A/perfect SAT students. Consider Ball State's "C student" scholarship, endowed by alum David Letterman, or the scholarships that will be awarded to students who wore outfits made out of duct tape to the prom. Students who are the first in their family to attend college, children of active-duty military personnel, and even children of cancer survivors can find numerous programs looking to help them pay for college. Whatever your child's religion, ethnic background, hobby, interest, social affiliation, there is tuition money out there targeted at them. Some websites try to compile the opportunities for you. Typical of these is www.fastweb.com. Fill out a profile and it matches the student to hundreds of scholarships. You will get emails of new scholarships (internships, too) year round for which a student qualifies. The best part, many are no essay scholarships and some are legit sweepstakes offering college money from major companies. Full disclosure, my daughter won a scholarship through them a few years ago.

Shutterstock / zimmytws Congratulations! Your high school senior just got accepted into college. Yours, and quite a few others -- a large fraction of colleges announce their acceptances around early April. Now, you can brag to all the relatives, and quietly enjoy a profound sense of relief. No more nagging the kid to write those essays. But your work isn't over quite yet. You have just reached the round in determining the survival of the fittest form-fillers, what I call "Darwinnowing": financial aid forms and scholarship applications. More essays, more research, and more ink for the printer, and a whole new test of your mettle as a competitive applicant. The Name of the Game The object of this exercise is to have your offspring graduate with as little debt as possible. The average U.S. undergrad walked across the stage to pick up his diploma carrying $29,000 in student loan debt last year, according to The Project on Student Loan Debt. So maximizing grants and scholarships is key. You may have already received a financial aid award letter from your child's institution of choice, assuming you filed the Free Application for Federal Student Aid. Regardless of your income level, most financial aid offices require the FAFSA as a to financial aid. If you haven't filed this application, please do it . Treat the financial aid award letter as a jumping-off point. Contact the nice people at the school's financial aid office and ask if are there any other state, local, or federal scholarship programs your child qualifies for. Is this amount listed in the letter the maximum possible for your student? Are there any merit-based scholarships? Even after four years of helping my daughter apply, there are always new programs cropping up. If you are the parent of a rising college freshman, ask his or her high school guidance counselor. Most colleges have a decent handle on what's available, but some outside sources are valuable for find less-known scholarships. Your local newspaper may occasionally mention smaller scholarships from area businesses and fraternal organizations. If you can access its archives online, it could be worth searching them. Your employer may offer scholarships for children of employees; a quick trip to HR should suffice to find out. My local grocery store chain has a scholarship competition for teenagers that work over the summer. Keep your eyes peeled everywhere. Thinking Outside the Box There are many free to use websites that are a treasure trove of merit and need-based scholarships. And those awards aren't all targeted to the star athlete/straight A/perfect SAT students. Consider Ball State's "C student" scholarship, endowed by alum David Letterman, or the scholarships that will be awarded to students who wore outfits made out of duct tape to the prom. Students who are the first in their family to attend college, children of active-duty military personnel, and even children of cancer survivors can find numerous programs looking to help them pay for college. Whatever your child's religion, ethnic background, hobby, interest, social affiliation, there is tuition money out there targeted at them. Some websites try to compile the opportunities for you. Typical of these is www.fastweb.com. Fill out a profile and it matches the student to hundreds of scholarships. You will get emails of new scholarships (internships, too) year round for which a student qualifies. The best part, many are no essay scholarships and some are legit sweepstakes offering college money from major companies. Full disclosure, my daughter won a scholarship through them a few years ago. LONDON (CNNMoney) Islamist militant gains in Iraq sent world oil prices higher Monday, sparking concerns that this could hurt global economic growth, especially in Europe where the recovery seems to be faltering.

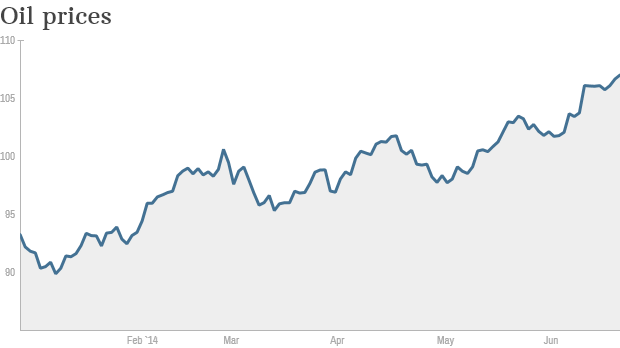

LONDON (CNNMoney) Islamist militant gains in Iraq sent world oil prices higher Monday, sparking concerns that this could hurt global economic growth, especially in Europe where the recovery seems to be faltering.  Deutsche Bundesbank, Frankfurt am Main/AP LONDON -- Gold rose Friday ahead of a series of speeches by U.S. Federal Reserve officials but was still on track for its biggest weekly fall since November following the Fed's hints of an interest rate hike in the first half of 2015. Fed officials including Richard Fisher, James Bullard and Narayana Kocherlakota are due to speak later Friday after Fed Chair Janet Yellen surprised markets mid-week by suggesting the possibility of raising interest rates early next year. Spot gold was up 0.6 percent to $1,336.40 an ounce by 1508 GMT (11:08 a.m. Eastern time), after falling to $1,320.24 on Thursday, its weakest since end-February. U.S. gold futures gained 0.5 percent to $1,336.80 an ounce. On Monday bullion briefly touched a six-month high of $1,391.76 on tensions in Ukraine and concerns about growth in China before the focus shifted towards the U.S. monetary stance. It was on course for a 3.1 percent weekly fall. "After the Fed policy meeting we saw gold fall and touch support around $1,320," MKS SA head of trading Afshin Nabavi said. "But with tensions again escalating between Russia and the West, the market has become more jumpy because it is not only the macroeconomics driving prices but also the political situation, at least in the short term." European and U.S. shares edged higher, while the dollar hovered near a three-week high against a basket of major currencies and 10-year U.S. Treasury yields rose above 2.7 percent. "The main longer-term factors remain expectations for higher yields, higher interest rates and a stronger dollar, which are negative for the metal," ABN Amro commodity analyst Georgette Boele said. Low interest rates, which cut the opportunity cost of holding non-yielding bullion above other assets, had been a key factor driving bullion higher in recent years. An escalation of U.S. sanctions against Russia over the crisis in Crimea kept investors cautious, giving support to gold, usually seen as an insurance against risk, analysts said. U.S. President Barack Obama raised the stakes in the East-West confrontation on Thursday by targeting some of Russian President Vladimir Putin's closest long-time political and business allies with personal sanctions. Physical Buying The physical sector noted light buying from jewelers, but demand from main consumer China remained slow because of a weak yuan. Premiums for gold bars in Hong Kong were unchanged from last week at $1 an ounce to the spot London prices. China's yuan fell to a 13-month low on Friday and was set to post its biggest weekly fall after the central bank lowered the midpoint of its permitted trading range, which is seen as a signal of official comfort with the currency's recent losses. Weakening differentials between 99.99 percent purity gold on the Shanghai Gold Exchange and cash gold discouraged imports. "Shanghai gold exchange is still at discounts to spot gold, and the market wants to know if the yuan will continue to depreciate," a physical dealer in Hong Kong said. Gold jewellery exports from India edged up 1 percent in February to $718.36 million from a year earlier, an industry body statement said on Thursday. In other precious metals, palladium rose 4 percent to $795.00 an ounce, its highest since August 2011, boosted by the launch of two exchange-traded funds in South Africa and increasing sanctions by Western countries on main producer Russia. Silver rose 0.6 percent to $20.39 an ounce and platinum gained 0.5 percent at $1,435.50 an ounce. -.

Deutsche Bundesbank, Frankfurt am Main/AP LONDON -- Gold rose Friday ahead of a series of speeches by U.S. Federal Reserve officials but was still on track for its biggest weekly fall since November following the Fed's hints of an interest rate hike in the first half of 2015. Fed officials including Richard Fisher, James Bullard and Narayana Kocherlakota are due to speak later Friday after Fed Chair Janet Yellen surprised markets mid-week by suggesting the possibility of raising interest rates early next year. Spot gold was up 0.6 percent to $1,336.40 an ounce by 1508 GMT (11:08 a.m. Eastern time), after falling to $1,320.24 on Thursday, its weakest since end-February. U.S. gold futures gained 0.5 percent to $1,336.80 an ounce. On Monday bullion briefly touched a six-month high of $1,391.76 on tensions in Ukraine and concerns about growth in China before the focus shifted towards the U.S. monetary stance. It was on course for a 3.1 percent weekly fall. "After the Fed policy meeting we saw gold fall and touch support around $1,320," MKS SA head of trading Afshin Nabavi said. "But with tensions again escalating between Russia and the West, the market has become more jumpy because it is not only the macroeconomics driving prices but also the political situation, at least in the short term." European and U.S. shares edged higher, while the dollar hovered near a three-week high against a basket of major currencies and 10-year U.S. Treasury yields rose above 2.7 percent. "The main longer-term factors remain expectations for higher yields, higher interest rates and a stronger dollar, which are negative for the metal," ABN Amro commodity analyst Georgette Boele said. Low interest rates, which cut the opportunity cost of holding non-yielding bullion above other assets, had been a key factor driving bullion higher in recent years. An escalation of U.S. sanctions against Russia over the crisis in Crimea kept investors cautious, giving support to gold, usually seen as an insurance against risk, analysts said. U.S. President Barack Obama raised the stakes in the East-West confrontation on Thursday by targeting some of Russian President Vladimir Putin's closest long-time political and business allies with personal sanctions. Physical Buying The physical sector noted light buying from jewelers, but demand from main consumer China remained slow because of a weak yuan. Premiums for gold bars in Hong Kong were unchanged from last week at $1 an ounce to the spot London prices. China's yuan fell to a 13-month low on Friday and was set to post its biggest weekly fall after the central bank lowered the midpoint of its permitted trading range, which is seen as a signal of official comfort with the currency's recent losses. Weakening differentials between 99.99 percent purity gold on the Shanghai Gold Exchange and cash gold discouraged imports. "Shanghai gold exchange is still at discounts to spot gold, and the market wants to know if the yuan will continue to depreciate," a physical dealer in Hong Kong said. Gold jewellery exports from India edged up 1 percent in February to $718.36 million from a year earlier, an industry body statement said on Thursday. In other precious metals, palladium rose 4 percent to $795.00 an ounce, its highest since August 2011, boosted by the launch of two exchange-traded funds in South Africa and increasing sanctions by Western countries on main producer Russia. Silver rose 0.6 percent to $20.39 an ounce and platinum gained 0.5 percent at $1,435.50 an ounce. -.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  90.91 (1y: +58%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AAPL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372050000000,57.506],[1372136400000,57.519],[1372222800000,56.867],[1372309200000,56.254],[1372395600000,56.647],[1372654800000,58.46],[1372741200000,59.784],[1372827600000,60.114],[1373000400000,59.631],[1373259600000,59.293],[1373346000000,60.336],[1373432400000,60.104],[1373518800000,61.041],[1373605200000,60.93],[1373864400000,61.063],[1373950800000,61.456],[1374037200000,61.473],[1374123600000,61.68],[1374210000000,60.707],[1374469200000,60.901],[1374555600000,59.856],[1374642000000,62.93],[1374728400000,62.643],[1374814800000,62.999],[1375074000000,63.97],[1375160400000,64.76],[1375246800000,64.647],[1375333200000,65.239],[1375419600000,66.077],[1375678800000,67.064],[1375765200000,66.464],[1375851600000,66.426],[1375938000000,65.859],[1376024400000,64.921],[1376283600000,66.766],[1376370000000,69.939],[1376456400000,71.214],[1376542800000,71.13],[1376629200000,71.761],[1376888400000,72.534],[1376974800000,71.581],[1377061200000,71.766],[1377147600000,71.851],[1377234000000,71.574],[1377493200000,71.853],[1377579600000,69.799],[1377666000000,70.128],[1377752400000,70.243],[1377838800000,69.602],[1378184400000,69.797],[1378270800000,71.242],[1378357200000,70.753],[1378443600000,71.174],[1378702800000,72.31],[1378789200000,70.663],[1378875600000,66.816],[1378962000000,67.527],[1379048400000,66.414],[1379307600000,64.303],[1379394000000,65.046],[1379480400000,66.383],[1379566800000,67.471],[1379653200000,66.773],[1379912400000,70.091],[1379998800000,69.871],[1380085200000,68.79],[1380171600000,69.46],[1380258000000,68.964],[1380517200000,68.107],[1380603600000,69.709],[1380690000000,69.937],[1380776400000,69.059],[1380862800000,69.004],[1381122000000,69.679],[1381208400000,68.706],[1381294800000,69.513],[1381381200000,69.948],[1381467600000,70.402],[1381726800000,70.863],[1381813200000,71.24],[1381899600000,71.588],[1381986000000,72.071],[1382072400000,72.699],[1382331600! 000,74.48],[1382418000000,74.267],[1382504400000,74.994],[1382590800000,75.987],[1382677200000,75.137],[1382936400000,75.697],[1383022800000,73.811],[1383109200000,74.985],[1383195600000,74.672],[1383282000000,74.29],[1383544800000,75.25],[1383631200000,75.064],[1383717600000,74.417],[1383804000000,73.213],[1383890400000,74.366],[1384149600000,74.15],[1384236000000,74.287],[1384322400000,74.376],[1384408800000,75.451],[1384495200000,74.999],[1384754400000,74.09],[1384840800000,74.221],[1384927200000,73.571],[1385013600000,74.448],[1385100000000,74.257],[1385359200000,74.82],[1385445600000,76.2],[1385532000000,77.994],[1385704800000,79.439],[1385964000000,78.747],[1386050400000,80.903],[1386136800000,80.714],[1386223200000,81.129],[1386309600000,80.003],[1386568800000,80.919],[1386655200000,80.793],[1386741600000,80.194],[1386828000000,80.077],[1386914400000,79.204],[1387173600000,79.643],[1387260000000,79.284],[1387346400000,78.681],[1387432800000,77.78],[13875

90.91 (1y: +58%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AAPL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372050000000,57.506],[1372136400000,57.519],[1372222800000,56.867],[1372309200000,56.254],[1372395600000,56.647],[1372654800000,58.46],[1372741200000,59.784],[1372827600000,60.114],[1373000400000,59.631],[1373259600000,59.293],[1373346000000,60.336],[1373432400000,60.104],[1373518800000,61.041],[1373605200000,60.93],[1373864400000,61.063],[1373950800000,61.456],[1374037200000,61.473],[1374123600000,61.68],[1374210000000,60.707],[1374469200000,60.901],[1374555600000,59.856],[1374642000000,62.93],[1374728400000,62.643],[1374814800000,62.999],[1375074000000,63.97],[1375160400000,64.76],[1375246800000,64.647],[1375333200000,65.239],[1375419600000,66.077],[1375678800000,67.064],[1375765200000,66.464],[1375851600000,66.426],[1375938000000,65.859],[1376024400000,64.921],[1376283600000,66.766],[1376370000000,69.939],[1376456400000,71.214],[1376542800000,71.13],[1376629200000,71.761],[1376888400000,72.534],[1376974800000,71.581],[1377061200000,71.766],[1377147600000,71.851],[1377234000000,71.574],[1377493200000,71.853],[1377579600000,69.799],[1377666000000,70.128],[1377752400000,70.243],[1377838800000,69.602],[1378184400000,69.797],[1378270800000,71.242],[1378357200000,70.753],[1378443600000,71.174],[1378702800000,72.31],[1378789200000,70.663],[1378875600000,66.816],[1378962000000,67.527],[1379048400000,66.414],[1379307600000,64.303],[1379394000000,65.046],[1379480400000,66.383],[1379566800000,67.471],[1379653200000,66.773],[1379912400000,70.091],[1379998800000,69.871],[1380085200000,68.79],[1380171600000,69.46],[1380258000000,68.964],[1380517200000,68.107],[1380603600000,69.709],[1380690000000,69.937],[1380776400000,69.059],[1380862800000,69.004],[1381122000000,69.679],[1381208400000,68.706],[1381294800000,69.513],[1381381200000,69.948],[1381467600000,70.402],[1381726800000,70.863],[1381813200000,71.24],[1381899600000,71.588],[1381986000000,72.071],[1382072400000,72.699],[1382331600! 000,74.48],[1382418000000,74.267],[1382504400000,74.994],[1382590800000,75.987],[1382677200000,75.137],[1382936400000,75.697],[1383022800000,73.811],[1383109200000,74.985],[1383195600000,74.672],[1383282000000,74.29],[1383544800000,75.25],[1383631200000,75.064],[1383717600000,74.417],[1383804000000,73.213],[1383890400000,74.366],[1384149600000,74.15],[1384236000000,74.287],[1384322400000,74.376],[1384408800000,75.451],[1384495200000,74.999],[1384754400000,74.09],[1384840800000,74.221],[1384927200000,73.571],[1385013600000,74.448],[1385100000000,74.257],[1385359200000,74.82],[1385445600000,76.2],[1385532000000,77.994],[1385704800000,79.439],[1385964000000,78.747],[1386050400000,80.903],[1386136800000,80.714],[1386223200000,81.129],[1386309600000,80.003],[1386568800000,80.919],[1386655200000,80.793],[1386741600000,80.194],[1386828000000,80.077],[1386914400000,79.204],[1387173600000,79.643],[1387260000000,79.284],[1387346400000,78.681],[1387432800000,77.78],[13875

Jason Myers for the Wall Street Journal

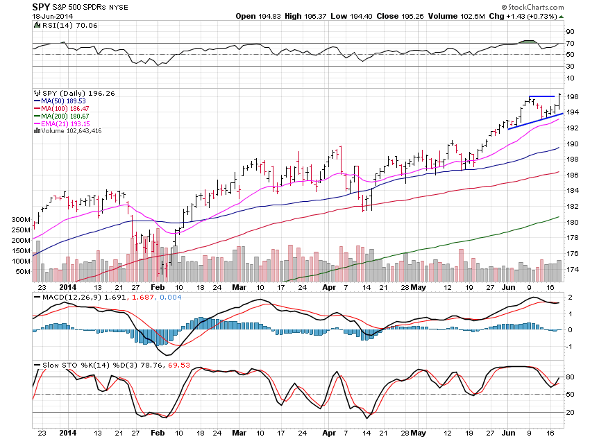

Jason Myers for the Wall Street Journal  SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

SPY is now breaking out of the wedge pattern and off to the races. Nice volume pushed it to the breakout point which is what I always like to see.

Reuters

Reuters