BALTIMORE (Stockpickr) -- "Don't make me pull this car over," scolded Fed Chair Janet Yellen, warning of rate hikes and stimulus cuts on the horizon (but this time for real).

Read More: Warren Buffett's Top 10 Dividend Stocks

No, the Fed meeting yesterday afternoon didn't come with any bombshells. After a little squirt of intraday volatility after the press conference, all three big indices ended Wednesday's session within a few basis points of where they were just before 2 p.m., when the meeting began. But if more of the same rhetoric from the Fed means more of the same in the equity markets, that's a good problem to have. Recall that stocks have been on a tear in the last few years -- and a very tradable one at that.

So to take advantage of a "more of the same" market, we're taking a technical look at five big-name stocks to trade for gains this week.

If you're new to technical analysis, here's the executive summary.

Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms, and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five high-volume stocks to trade this week.

Read More: 5 Hated Earnings Stocks You Should Love

Thermo Fisher Scientific

There's no two ways about it: Thermo Fisher Scientific (TMO) has made an impressive run in the last year. Since September 2013, this laboratory supply house has rallied more than 35%, climbing almost twice as far as the S&P 500 over that same 12-month stretch. And while shares have been trading sideways for most of 2014, the real moves could just be about to happen. TMO looks ready to kick off a second rally leg here.

That's because Thermo Fisher is currently forming an ascending triangle pattern, a bullish price setup that's formed by horizontal resistance above shares (in this case at $126) and uptrending support to the downside. Basically, as TMO bounces in between those two technically important price levels, it's getting squeezed closer to a breakout above that $126 price ceiling. When that happens, we've got a buy signal.

Why all of that significance at that level? It all comes down to buyers and sellers. Price patterns like the ascending triangle are a good quick way to identify what's going on in the price action, but they're not the actual reason a stock is tradable. Instead, the "why" comes down to basic supply and demand for TMO's stock.

The $126 resistance level is a price where there has been an excess of supply of shares; in other words, it's a spot where sellers have previously been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $126 so significant: The move means that buyers are finally strong enough to absorb all of the excess supply above that price level. It makes sense to sit on the sidelines until the breakout is confirmed with a close above that $126 mark.

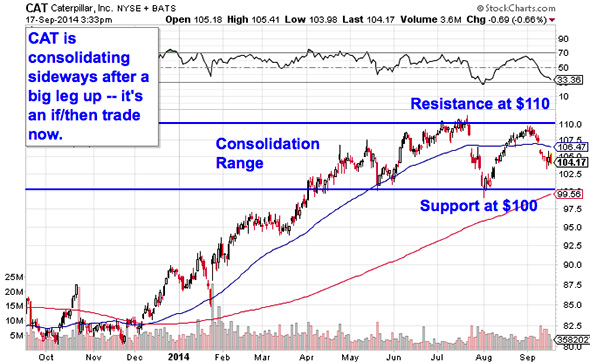

Caterpillar

Heavy equipment maker Caterpillar (CAT) is another name that's been consolidating sideways after a hard rally in the past year. After rallying more than 20% since last September, CAT has been effectively flat since the middle of May. But that sideways slump is setting things up for a meaningful move. Here's how to trade it.

The sideways action in Caterpillar is forming a rectangle pattern, a consolidation setup formed by a pair of horizontal resistance and support levels that basically "box in" shares between $100 and $110. Consolidations like the one in CAT are common after big moves (like the one that started in last fall); they give the stock a chance to bleed off momentum as buyers and sellers figure out their next move.

Rectangles are "if/then patterns." Put a different way, if Caterpillar breaks out through resistance at $110, then traders have a buy signal. Otherwise, if the stock violates support at $100, then the high-probability trade is a sell. Since this stock's price action leading up to the rectangle was an uptrend, it favors breaking out above $110.

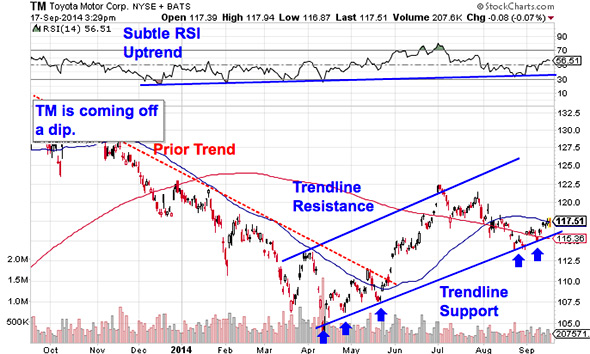

Toyota Motor

Japanese auto giant Toyota Motor (TM), on the other hand, hasn't had a particularly good run in the last year. In fact, it's been downright toxic for your portfolio's health: shares are down 7.5% since last September, underperforming the S&P 500 by more than 25%. But we're coming up on a big buying opportunity in Toyota this week, and you don't need to be an expert technical trader to figure out why...

Toyota broke its downtrend at the end of May, and it's been bouncing its way higher in a well-defined uptrending channel ever since. So, as Toyota tests that key support line for a fourth time here, we're coming up on what looks like another great opportunity to get into shares. Every test of support this summer has been a low-risk, high-reward entry-point in TM, and there's no reason to think that this time it's different.

Momentum adds some extra confidence in Toyota's upside potential right now: 14-day RSI has been in a shallow uptrend since just before the trend changed in TM's price, and that uptrend is still intact now. That's a good indication that buyers have been getting more aggressive in this stock as we head deeper into September.

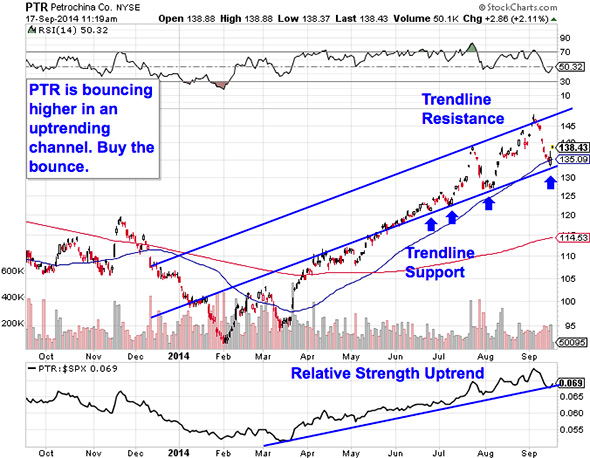

PetroChina

We're seeing the same setup in shares of Chinese national oil and gas company PetroChina (PTR). Like Toyota, PTR has been bouncing its way higher in a well-defined uptrend since the beginning of the summer – the big difference in PetroChina is that this stock only transitioned from one uptrend to another one at that point. But with shares testing support for a fourth time this week, it makes sense to buy the bounce.

Waiting for this week's bounce is important for two key reasons: it's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're ensuring PTR can actually still catch a bid along that line before you put your money on shares.

Finally, relative strength is the side indicator that's adding confidence to upside in PetroChina here: relative strength line has been in an uptrend of its own since mid-March, indicating that PTR is outperforming the S&P 500 in good times and bad ones. As long as that uptrend remains intact, PetroChina should keep doing better than the broad market.

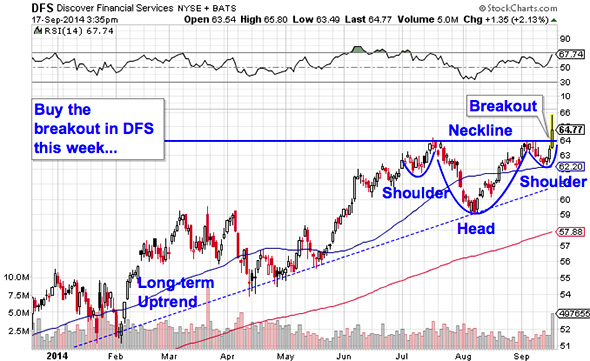

Discover Financial Services

Last up is Discover Financial Services (DFS). Discover is in breakout mode right now – shares pushed above $64 resistance after forming a classic inverse head and shoulders pattern since the start of July. That means now's the time to be a buyer in DFS.

The inverse head and shoulders pattern in Discover is a bullish setup that indicates exhaustion among sellers. You can spot the inverse head and shoulders by looking for two swing lows that bottom out around the same level (the shoulders), separated by a bigger trough called the head; the buy signal comes on the breakout above the pattern's "neckline" level (that's our $64 price level in DFS).

Looking longer-term, Discover in in a multiyear uptrend that's propelled this stock more than 339% in the past five years. So while "breakout mode" is nothing new for long-time owners in DFS, this week's breakout makes it a high reward-to-risk scenario. For new entrants to this stock, I'd recommend parking a protective stop on the other side of the 50-day moving average -- that level is acting as a proxy for support this month.

To see this week's trades in action, check out the Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment