Paul Krugman is joining a growing contingent of economists and money managers from Carmen Reinhart to Mark Mobius in warning of a meltdown in emerging markets.

The Nobel Prize-winning economist said the current episode bears some resemblance to the Asian financial crisis in the late 1990s, when developing-nation stocks slid 59 percent and governments raised interest rates to exceptionally high levels.

"It’s become at least possible to envision a classic 1997-8 style self-reinforcing crisis: emerging market currency falls, causing corporate debt to blow up, causing stress on the economy, causing further fall in the currency," Krugman wrote on Twitter.

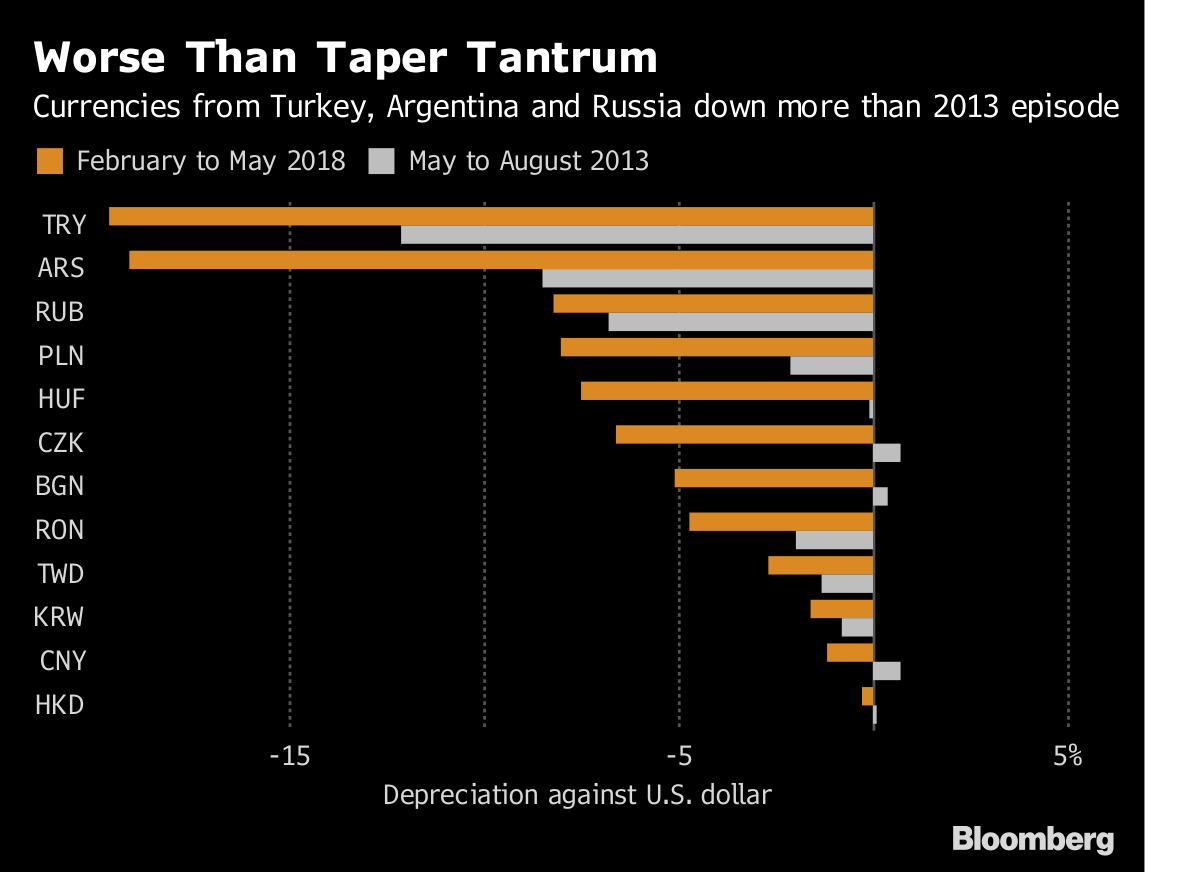

In fact, a dozen emerging-market currencies have fallen more since February than they did during the 2013 taper tantrum, which marked its five-year anniversary on Tuesday.

Worse Than Taper TantrumCurrencies from Turkey, Argentina and Russia down more than 2013 episode

.chart-js { display: none; }

Still, Krugman was reluctant to forecast full-blown contagion.

"Are we seeing the start of another global financial crisis? Probably not -- but I’ve been saying that there was no hint of such a crisis on the horizon, and I can’t say that anymore," he wrote. "Something slightly scary this way comes."

Even Emerging-Markets Bull Mark Mobius Sees More Pain Ahead

Harvard’s Reinhart Says Emerging Markets Worse Than ’08 Crisis

No comments:

Post a Comment